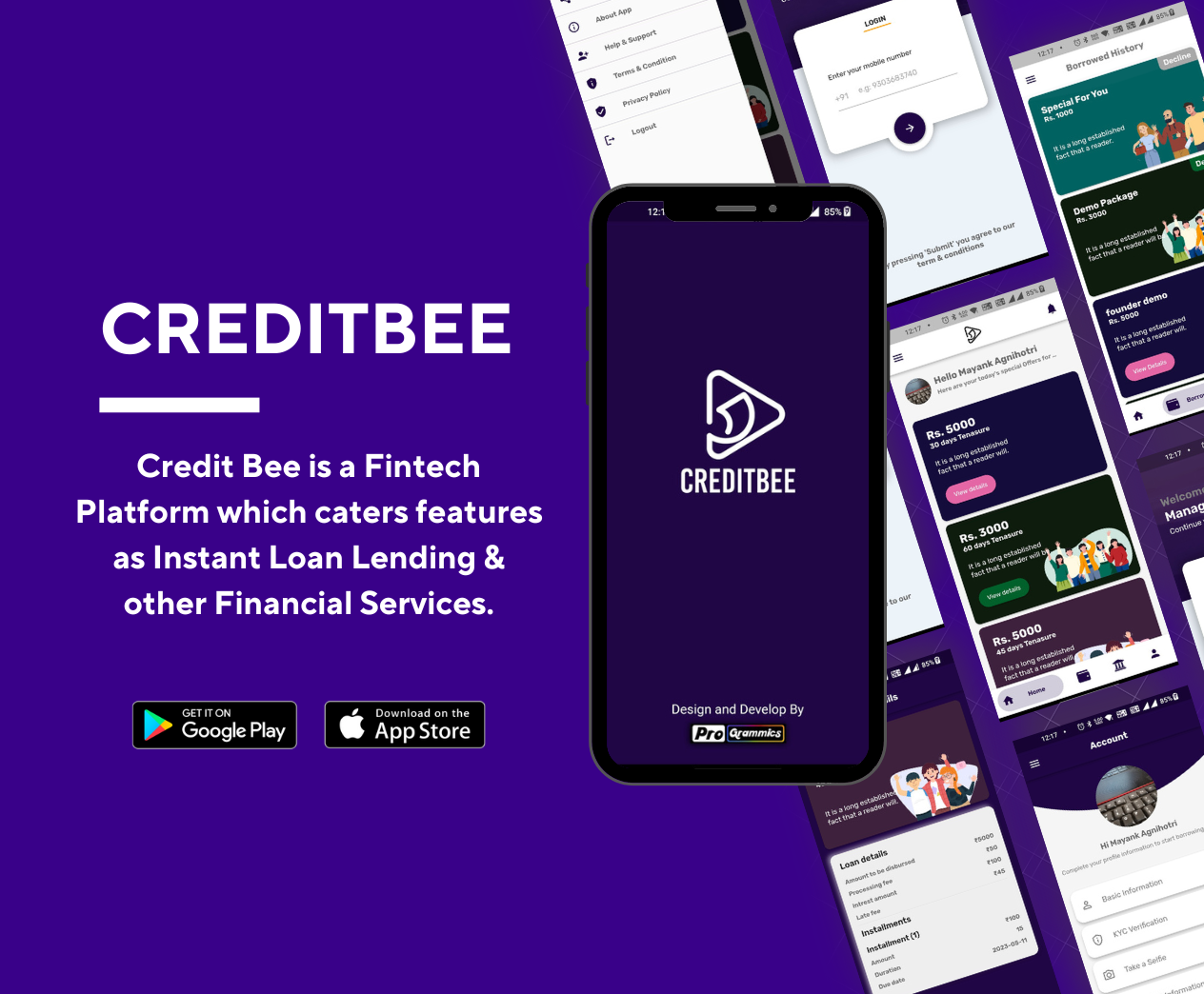

Instant Loan Lending Fintech Application

- Category Application

- Client CreditBee Finance

- Start Date 11 January 2023

- In Beta

An advanced loan lending & financial services-based fintech Application should possess several key features. Here is the List 5 essential features:

We have developed a fully functional advanced loan lending & financial services-based fintech Application for the brand named CreditBee Finance. CreditBee Finance is a startup that works in the finance domain and has progressively developed an application to cater to its audience. The Application is currently in limited user testing(Beta) mode and not available to the public.

- 1. Online Loan Applications: The application should allow users to apply for loans online, providing a streamlined and paperless process. It should include features such as pre-qualification assessments, document uploads, and electronic signatures, making it convenient for users to submit loan applications.

- 2. Loan Calculators and Comparison Tools: The application should include loan calculators that allow users to estimate monthly payments, interest rates, and loan terms based on their desired loan amount. Additionally, comparison tools enable users to compare different loan options and choose the most suitable one for their needs.

- 3. Credit Scoring and Risk Assessment: Incorporating credit scoring algorithms and risk assessment models helps evaluate the creditworthiness of loan applicants. This feature enables lenders to assess the likelihood of loan repayment and make informed decisions regarding loan approvals and interest rates.

- 4. Account Management and Payment Processing: The application should provide users with a dashboard to manage their loan accounts, view payment schedules, make payments online, and set up automated payment reminders. This feature enhances convenience and allows users to stay on top of their loan obligations.

- 5. Financial Education and Resources: Including educational resources, such as articles, videos, and tools related to financial literacy and money management, helps users make informed decisions about loans and financial services. This feature promotes financial well-being and empowers users with knowledge to make sound financial choices.

- These key features, combined with data security measures, customer support channels, personalized recommendations, and integration with other financial services, contribute to an advanced loan lending and financial services-based fintech application that offers a seamless and user-centric experience for borrowers and lenders.

- Reach out to Programmics Technology for your Online Healthcare Booking App Today -

Contact Now!